Global Real Estate Housing Markets Remain Strong

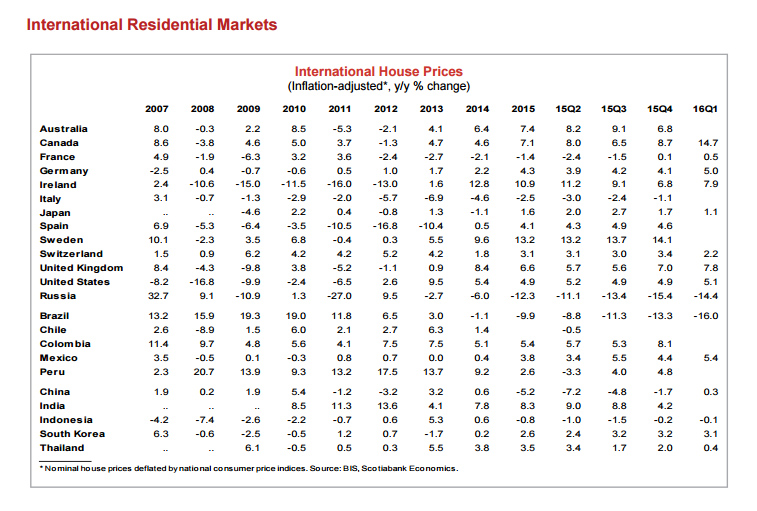

Continued low interest rates are driving the key global housing markets, in spite of relatively sluggish economic growth and heightened financial market volatility. The IMF has estimated that roughly three-quarters of global real estate markets are experiencing rising house prices. Strength in general has been predominantly in first world countries compared with emerging markets, though gains are being seen across all regions. Two notable exceptions are Brazil and Russia, where deep local recessions, rising unemployment and high interest rates continue to put significant downward pressure on housing demand and prices. Canada, Australia, Sweden and the U.K. are among the top performing residential markets internationally.

Tightened Lending Rules

The continued and ongoing rapid pace of house price appreciation has prompted authorities to further tighten mortgage lending rules. This includes increased down payment requirements (Canada), higher investor lending rates (Australia), stricter mortgage standards (Sweden) and new taxes on second homes and rental properties (U.K.). U.S. house prices continue to trend up amid strengthening sales and tight inventory. Solid fundamentals — pent up demand, a robust job market and rising household formation — should extend the recovery even in the face of moderately higher borrowing costs.

Affordability

Affordability is still acceptable in most countries surveyed, with average prices still about 20% below the 2008 pre-crisis peak adjusted for inflation, and the U.S. Federal Reserve engineering only a gradual firming in policy. Housing markets also are gradually firming in the euro zone. Average inflation-adjusted house prices across the region edged up 2% over the past year, a modest but defining turning point after several years of decline. However, conditions remain uneven, with strengthening labor markets supporting solid price gains in some member countries, notably Ireland, Spain and Germany, while other markets, including France and Italy, continue to languish alongside a weaker economic recovery.

Latin America and Asia

The majority of property markets in Latin America and Asia are showing moderate activity and price growth. China’s housing recovery is broadening, with roughly two-thirds of major centers reporting annual price growth through April. However, authorities face a tough policy balancing act in their attempt to cool skyrocketing prices in top-tier cities while at the same time support the nascent recovery in oversupplied smaller centers. Foreign capital inflows also are contributing to the recovery in global property markets, as investors search for geographical and asset diversification, and higher potential returns. This extends not just into residential real estate, but commercial properties and agricultural lands as well. A large share of these flows has been destined to the luxury property market in top-tier cities. Global real estate market sentiment remains vulnerable to shifts in the economic and financial climate. Sales of high-end luxury properties have cooled in a number of large markets over the past year, including New York, Hong Kong and London. The softening in demand mirrors the economic slowdowns in China and the Middle East, and deep recessions in Russia and Brazil, all key source markets of luxury foreign buyers. Affordability also is taking on added importance, with relatively lower prices and favorable exchange rate conversions benefiting some second-tier cities, including in Canada, Australia and the euro zone.

with files from Scotiabank Canada